40+ how to avoid private mortgage insurance

Web Private mortgage insurance PMI is a cost required by most mortgage lenders when a down payment does not equal at least 20 percent of the purchase price. To avoid PMI for most loans youll need at least 20 percent of the homes purchase price set aside for a down payment.

Examples Of Financial Institutions What Is The Difference

For example lets say you borrow 200000 to buy a.

. Though it is a large sum of money to pay all. Get a conventional loan and make a 20 down payment thats 10 cash and 10 a second loan. This means the loan-to-value ratio will be 80 or less meaning finding a down payment.

Trusted VA Home Loan Lender of 300000 Military Homebuyers. Ad Trade in Big Repair Bills for Big Savings - Research American Home Warranty Now. Trusted by over 15000000 Users.

Web Like mortgage rates PMI prices fluctuate based on real estate market conditions and a variety of other factors. Web With this method you avoid PMI since the LTV ratio on the first mortgage is 80 percent. Also called a piggyback the 80.

Once youve had your mortgage for a few years you may be able to get rid of PMI bAssuming you stay current with your mortgage payments PMI does eventually. But read on to see why thats not the only reason to come up. PMI is calculated as a.

Web How to Avoid PMI on Your Mortgage - SmartAsset Homebuyers need at least a 20 down payment to avoid private mortgage insurance. Web The cost of private mortgage insurance ranges depending on the particular lender and how much money you actually put down on the loan. Step 175 percent of the mortgage is actually.

Web The easiest way to avoid paying for private mortgage insurance would be to make a more substantial commitment to the home upfront. Compare Offers From Leading Providers and Find The Best American Home Warranty. Web Get rid of PMI with a piggyback.

But keep in mind that a second mortgage comes with a higher interest rate. Web 3 hours agoMaking a 20 down payment on a home could help you avoid private mortgage insurance. Ad More Veterans Than Ever are Buying with 0 Down.

Ad Private Mortgage Insurance. Estimate Your Monthly Payment Today. Web 12 hours agoOne of the simplest ways to avoid PMI is to have a down payment of 20.

Web How to avoid paying PMI. However PMI usually costs anywhere between 05 to 1 of. Shop around for a loan that doesnt require PMI Look for alternative loan programs that either waive the PMI requirement andor give.

Fast Free and Easy. EverQuote Partners with 160 Carriers across the US. Web Your lender will have you make PMI payments if your down payment is less than 20 of the loan amount.

Cheap Home Insurance in 3 mins. FHA consumers need to pay what exactly is named Home loan Insurance fees MIP. KCS Wealth Advisory LLC Los Angeles CAPut 20 down on your home purchase See more.

Web Sorts of Mortgage Insurance rates. Web Here are five ways you can avoid paying PMI.

Blog

What Is Pmi Understanding Private Mortgage Insurance

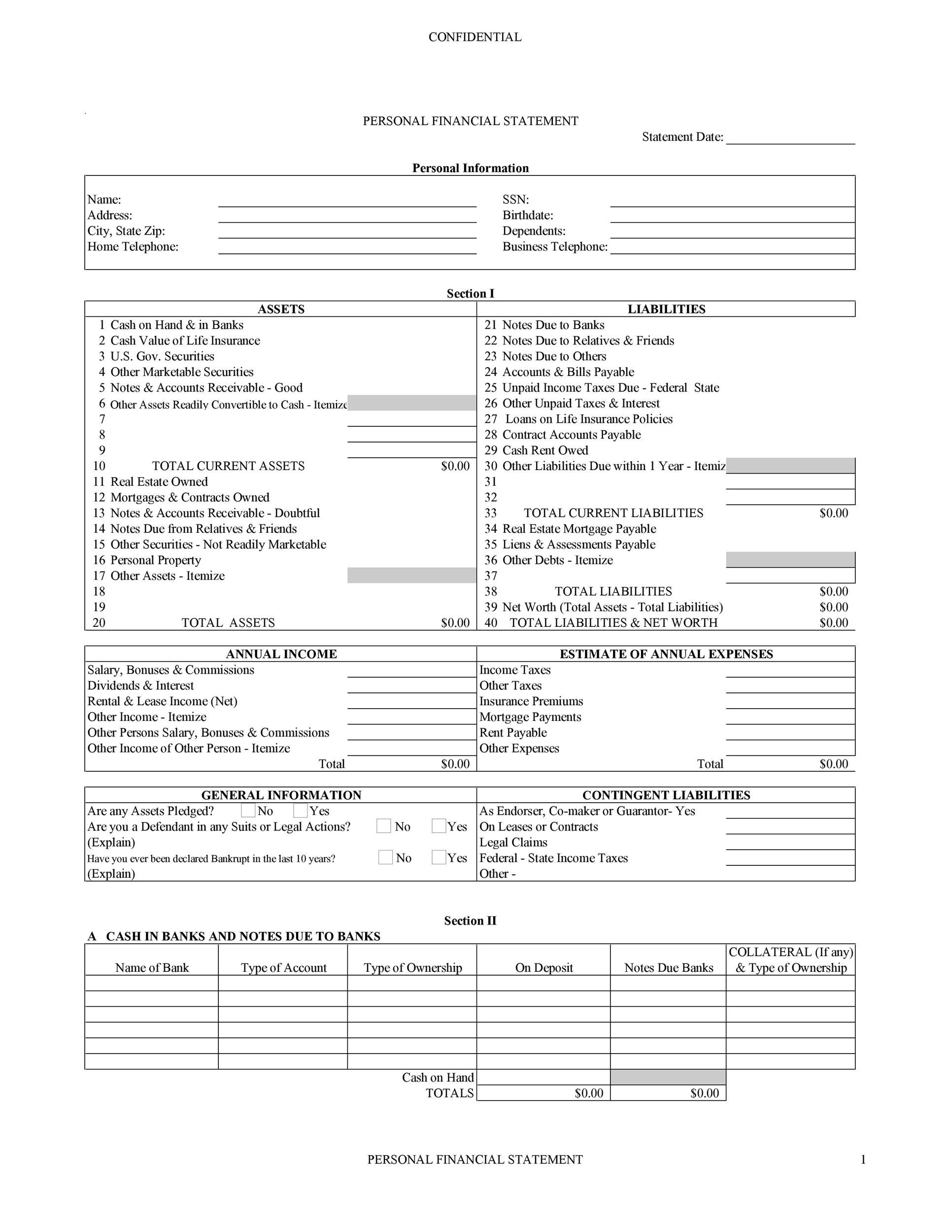

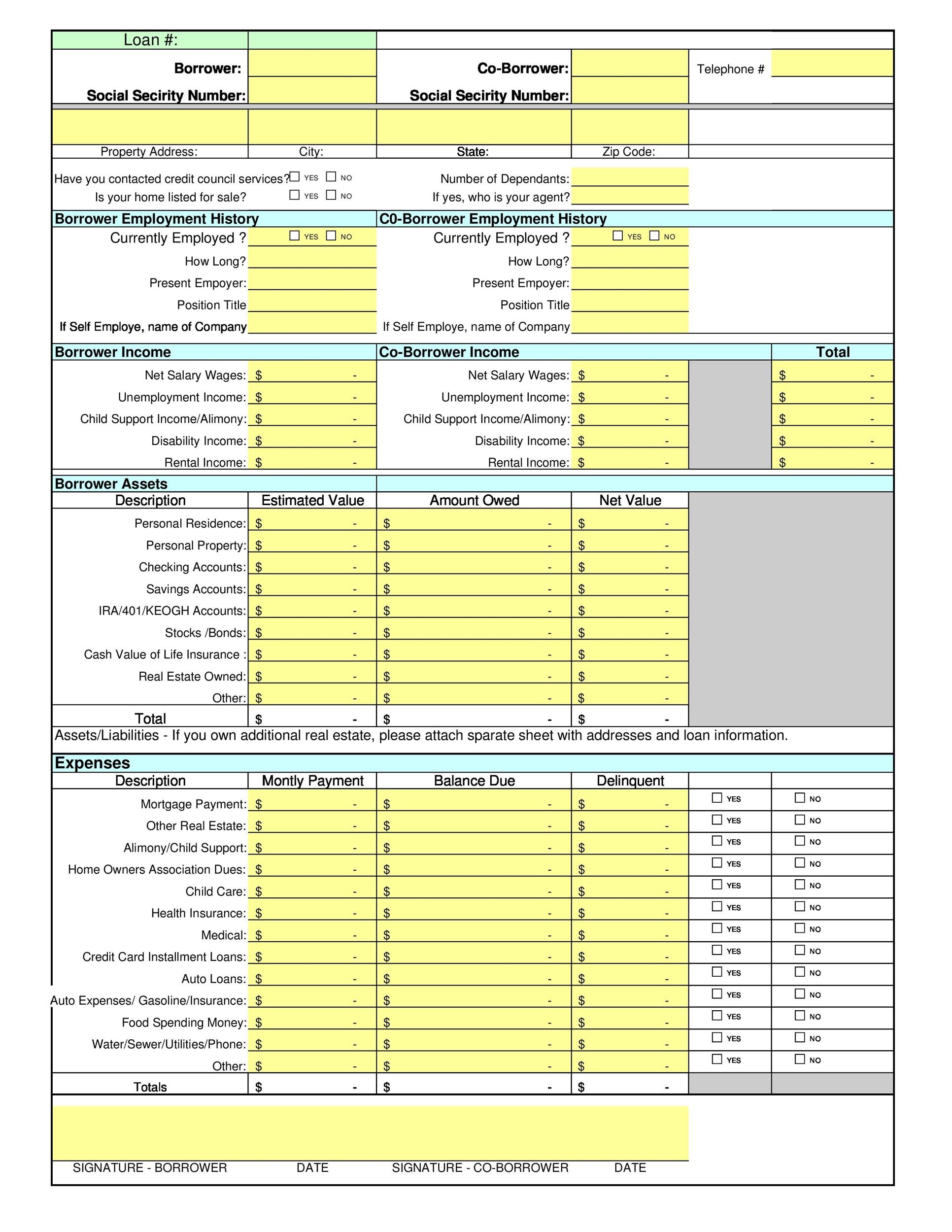

40 Personal Financial Statement Templates Forms ᐅ Templatelab

A Mortgage Lender S Guide To The Types Of Home Loans

:max_bytes(150000):strip_icc()/HowtoOutsmartPrivateMortgageInsurance4-032e9dfa86f4428395ca45cbb2628baf.png)

How To Outsmart Private Mortgage Insurance

Prepayment Risk Complete Guide On Prepayment Risk

When Should You Apply For And Start Your Mortgage Protection Policy Lion Ie

E4d 3zkv31lcfm

Occupational Disability Insurance In Germany 4 Best Offers In 2023

40 Gov T And Private Sector Programs Resources And Discounts For First Time Home Buyers

Gross Profit How To Use Gross Profit With Examples

How To Avoid Mortgage Insurance In 6 Ways Rwm Home Loans

40 Personal Financial Statement Templates Forms ᐅ Templatelab

Kaiserslautern American January 15 2021 By Advantipro Gmbh Issuu

5 Ways To Avoid Paying Private Mortgage Insurance Pmi Wealthtender

8 Rlpejwkq34dm

Ginnie Delivery Fee Collection Processing Insurance Warehouse Mgt Tools Celebrity Home Loans Goodbye Letter